Introduction - english

Navigation Menu

Introduction

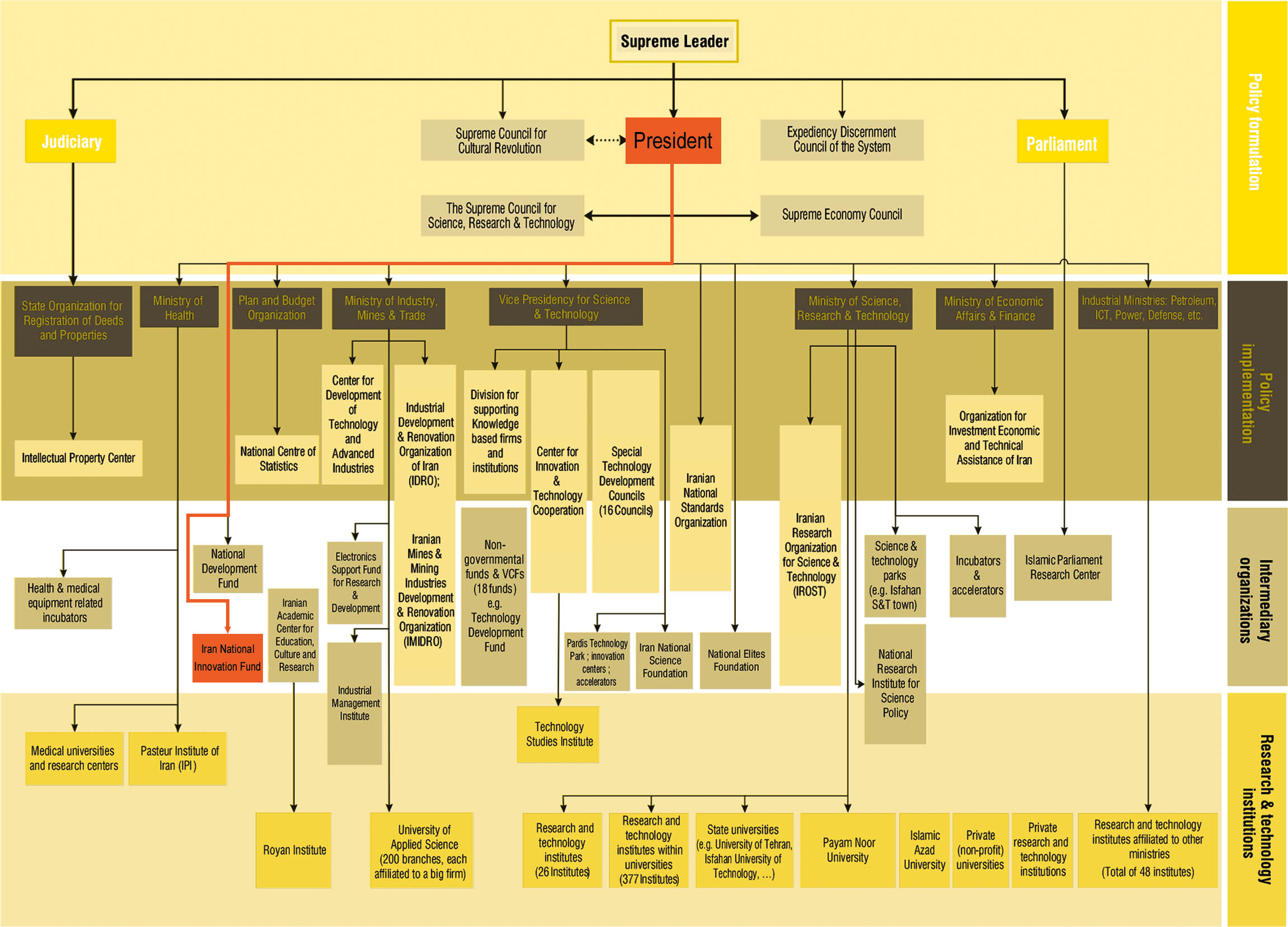

On the basis of The Support of Knowledge-based Institutions and Companies and Commercialization of Innovations and Inventions (PEKBOCI) Law, Innovation and Prosperity Fund (later known as Iran National Innovation Fund-INIF) was established in 2011, in order to assist the non-governmental institutions and companies in commercialization of innovations and inventions and also make the technical knowledge grow and become applicable by providing financial support and services to knowledge-based institutions and companies also known as New Technology Based Firms (NTBFs).

-

Resource: Science, Technology & Innovation Policy Review, Islamic Republic of Iran, UNCTAD (2016)

INIF in comparison with Banks and Financial Institutions:

-

Facility fees are less than the banks (up to 8% and in some cases up to 10% less than the rate approved by the National Council of Money and Credit).

-

The time required for receiving loans from INIF for knowledge-based companies is much less than the banks.

-

INIF requires less guarantees as compared with the banks, with the same condition.

-

Knowledge-based companies do not need to have a depositary or a cash contribution (similar to what is done in banks) to receive INIF’s financial facilities.

-

With lending loans to high risk projects, INIF helps the knowledge-based companies to grow and develop. However, banks usually refuse to provide facilities for these projects and do not accept such risks.